“Just pay 10% now. No EMI till possession.”

Most homebuyers hear this and feel a sense of relief. For them, it feels like a way to move forward without putting immediate pressure on monthly finances, especially when rent, savings and day-to-day expenses are already in play.

The problem is not the offer itself. The problem is that buyers agree to it without fully understanding how the payments actually work over time. Very few people are clearly told how interest is handled during construction or how these choices affect their EMI once the project is ready.

Today, under-construction properties come with several payment options and each one changes the timing of your cash outflow in a different way. None of these options are inherently wrong but they come with trade-offs that only become evident over time.

This blog aims to help you understand the payment plans so you know what you are getting into before you commit your money and your loan.

When Do Payment Plans Actually Apply?

Payment plans usually come into play when you are buying a home that is either a new launch or still under construction. In these cases, the building is not yet ready, so the developer allows the purchase price to be paid in parts over time.

If a project is already completed or ready to move in, payment plans typically do not apply. In such cases, the full amount is expected to be paid at the time of purchase, either entirely from your own funds or through a home loan that is disbursed upfront.

This distinction is important because many of the payment options discussed later in this blog only make sense when construction is still ongoing. Once a project is complete, there is very little flexibility in how payments are structured.

The Two Common Types of Payment Plans

When a project is under construction, developers usually offer payment plans in one of two broad formats. While there can be variations within each, most plans eventually fall into these buckets.

Construction-Linked Payment Plans

This is the most commonly used payment structure and also the easiest to understand.

Under a construction-linked payment plan, you pay the developer in stages as the building progresses. Each payment is tied to a specific construction milestone, such as the completion of excavation, the basement, plinth, individual floors, finishing work or possession.

In simple terms, you pay when work on the site moves forward. If construction slows down, payments also slow down. This alignment is the reason construction-linked plans became popular in the first place.

A typical plan usually starts with an initial payment at booking of 10-20%, followed by another payment at the time of agreement. After that, the remaining amount is spread across construction milestones until possession.

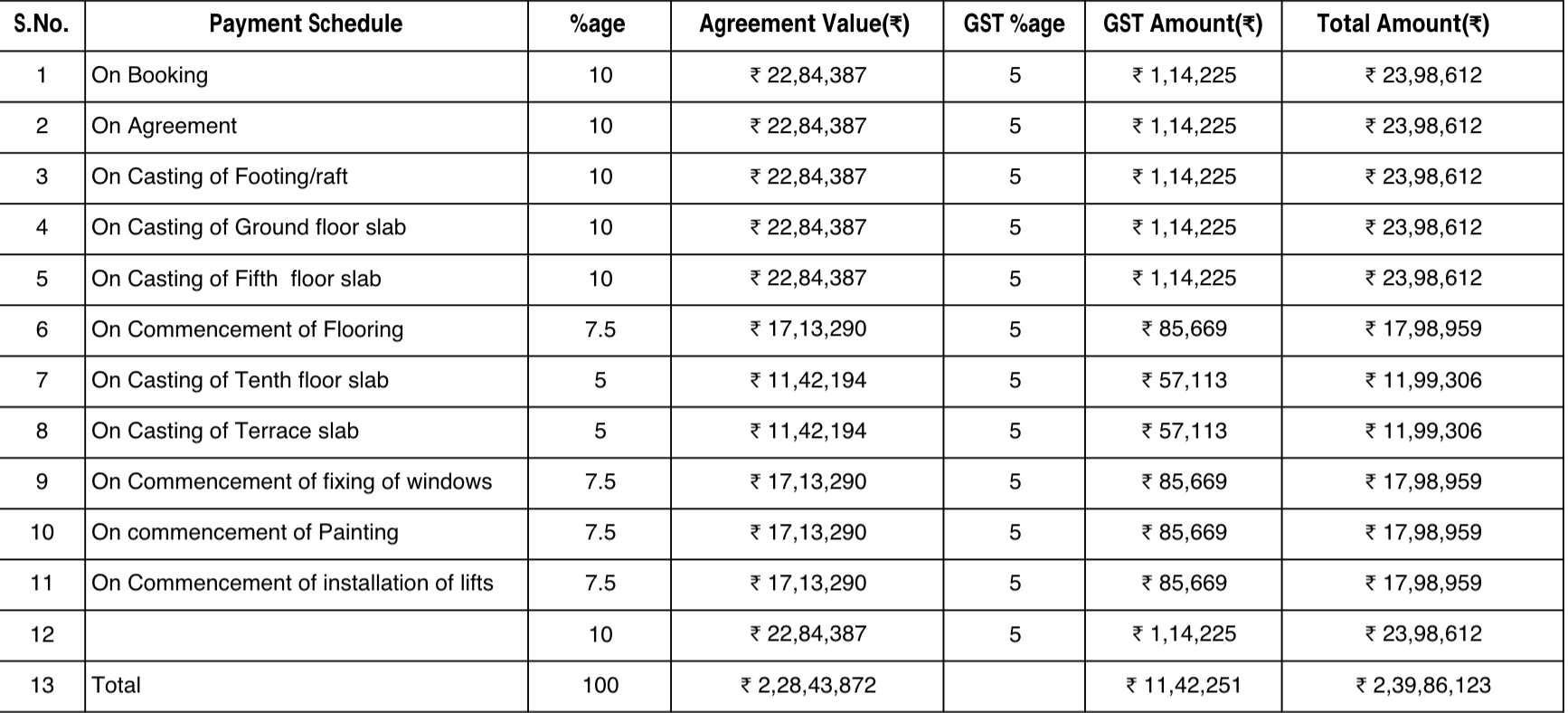

Here is an example of a typical payment plan:

Not all payment plans work the same way for every buyer.

Time-Linked Payment Plans

In a time-linked payment plan, payments are not connected to construction progress. Instead, they are scheduled at fixed time intervals such as every three months or every six months.

This means you could be asked to make a payment even if there has been little or no visible construction progress during that period.

Because of this disconnect, time-linked plans carry more risk for buyers and are less commonly preferred today. They may still be offered in certain projects, but buyers should be cautious and clearly understand what they are signing up for.

How Equity, Home Loans & Payment Plans Come Together?

Over the last few years, payment structures have evolved. Broadly, home purchases today are funded in one of two ways:

1. Funding the Purchase Using Your Own Equity

- You pay the developer directly from your own funds.

- Payments are made stage by stage using your savings or investments.

- No home loan is involved in this structure.

- The price is typically the base project price without any financing or interest cost built into it.

2. Funding the Purchase Through a Home Loan

- The home loan is taken in your name and you pay the upfront contribution, often around 10–20 percent.

- The lender disburses the loan to the developer in parts as construction progresses, usually linked to construction milestones.

What happens during construction: Pre-EMI (standard structure)

Pre-EMI refers to the payments you (buyer) make to the lender during the construction phase. This is usually the interest on the amount that has been disbursed so far.

Once the project is completed and possession is offered, the loan usually moves into regular EMIs, which include both principal and interest on the full outstanding amount.

Two ways this can be structured

- Interest-only pre-EMI: You pay only interest during construction and the principal remains largely unchanged until regular EMIs begin.

- Full EMI during construction (sometimes offered as an option): You start paying principal and interest earlier, which reduces the outstanding principal before possession and lowers long-term interest.

This works well for buyers who want to avoid paying rent and EMI at the same time.

However, it is important to understand that the interest during this period does not simply go away. The interest that accumulates while the project is under construction either has to be paid to the lender at the time of possession or gets added to your loan principal.

When this unpaid interest is added to the principal, your loan amount increases. As a result, when regular EMIs begin, you start paying interest not just on the original loan amount but also on the interest accumulated earlier.

Over a long loan tenure, this can significantly increase the total interest paid, which is why this situation is commonly referred to as 'interest on interest'.

The right choice depends on what you are comfortable with, how stable your current cash flows are, the kind of property you are buying and how you expect your income to change in the future.

👉 Plan Your Home Loan with Propsoch

If you are confident that you will be able to prepay the loan using future bonuses, incentives or ESOP payouts, you have more flexibility in choosing such schemes.

On the other hand, if you expect to rely primarily on your monthly salary to service the loan for most of the tenure, it becomes important to be cautious, as these structures can increase your long-term EMI burden.

While such situations were more common in the past, the introduction of RERA has significantly reduced this risk. Developers today invest substantial capital upfront in land acquisition, approvals and design, which makes abandoning a project far more difficult and legally risky.

Why Does Cash Flow Matter?

One of the biggest mistakes buyers make is evaluating a property investment only on the headline price.

If you are buying a property worth 1 cr using a 80% home loan, your actual investment is not 1 cr. Your equity outflow is closer to 20 lakhs. The remaining amount is funded by the lender.

The other major outflow from your pocket is the interest paid during construction. This interest is spread over two or three years, depending on the construction cycle and is not paid upfront. This spreading of cash outflows is what often improves returns in real estate investments.

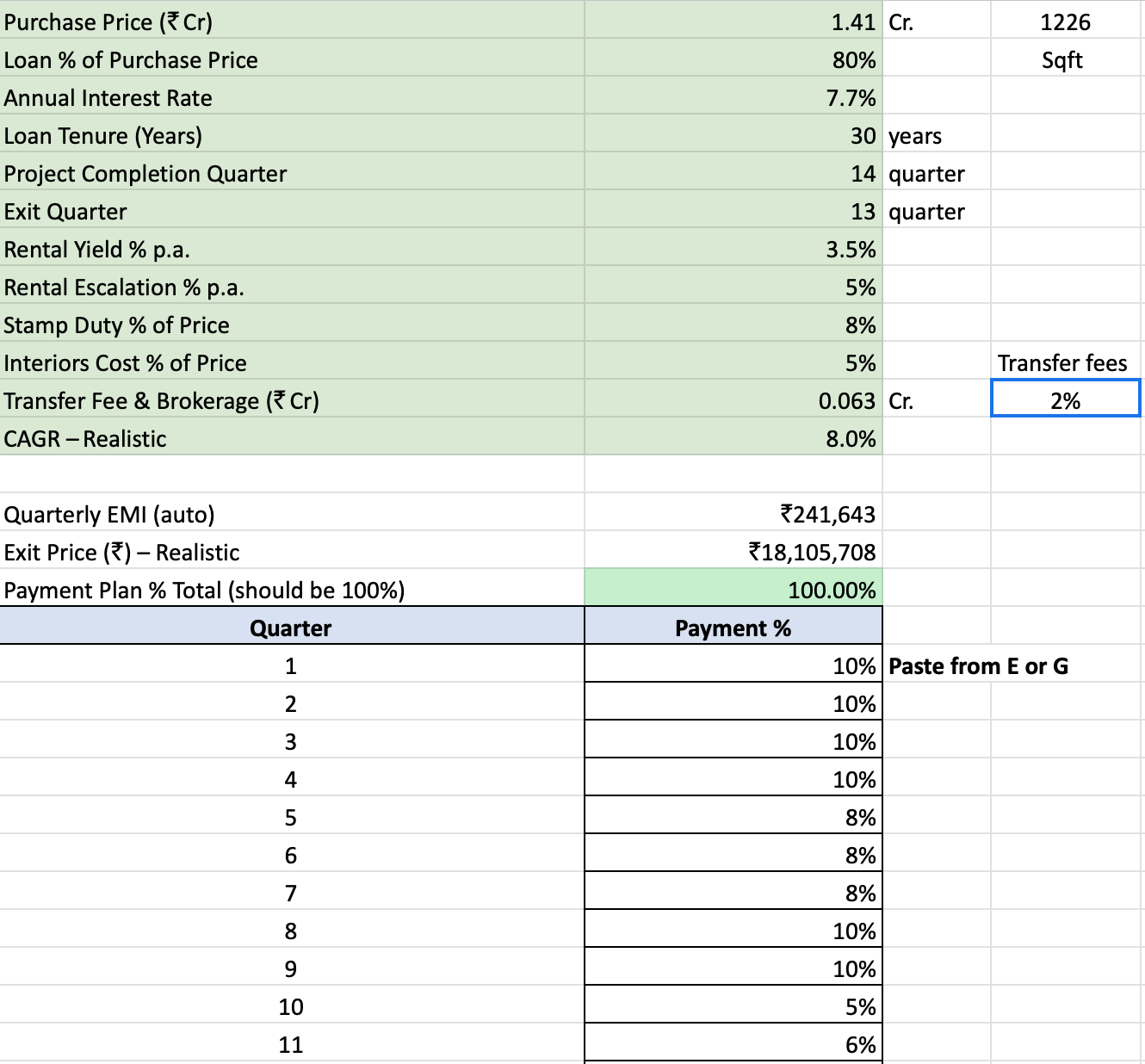

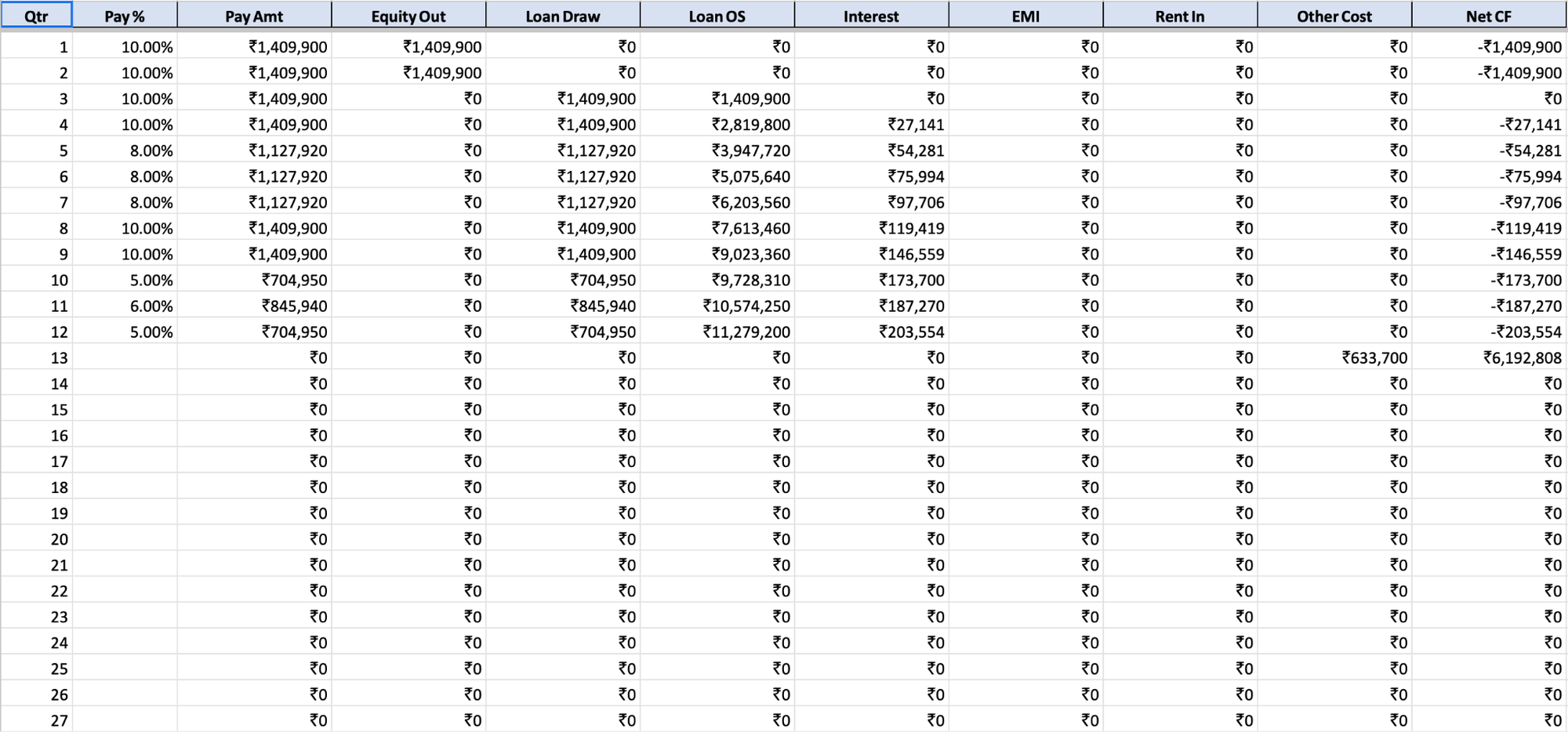

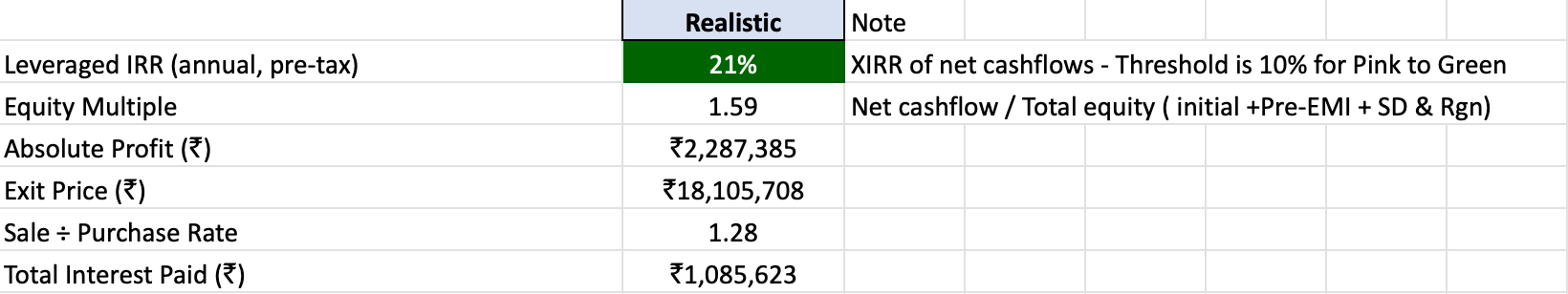

To help buyers evaluate this clearly, we have built the Propsoch Investment Calculator.

Below is a snapshot of the tool and the kind of insights it offers.

The tool allows you to assess returns based on how much equity you invest, how much loan you take, the payment plan you choose and whether you opt for pre-EMI or full EMI. It shows metrics such as IRR, ROI and equity multiples, which help bring clarity to decision-making.

But running the numbers is only one part of the decision. That’s why Guided Home Buying Program (GHB) exists at Propsoch.

With GHB, our experts help you choose the right payment plan, structure your home loan correctly and evaluate the property across 80+ financial and technical parameters before you commit.

If you are curious about how this process actually plays out for buyers, Ashish Acharya, Founder at Propsoch walks through the Guided Home Buying Program in a short video, explaining how we can help you avoid costly mistakes and make confident decisions.