While it has always moved in circles, 2026 Mumbai Real Estate outlook shows an entirely new pattern from earlier phases of growth.

“Mumbai’s investment story has come full circle, returning to pre-pandemic levels and crossing the USD 1 billion mark for the fourth year in a row.”

Report on Indian Real Estate (Q3 2025) by Cushman & Wakefield.

The narrative is shifting from short-term market movements to long-term urban transformation.

This is no longer just about rising prices or record sales numbers. Infrastructure, capital flows, buyer maturity and land scarcity are collectively reshaping where people choose to live, how they evaluate homes and why certain locations continue to outperform others over decades.

For anyone tracking Mumbai Real Estate closely, 2026 stands out as a year where many of these structural changes begin to take shape.

Mumbai Real Estate 2026: Strong Buyer Confidence

Mumbai’s residential market has demonstrated resilience over the past few years. Even as global economic conditions fluctuated, housing demand in the city remained consistent, particularly in mid-premium and luxury segments.

What stands out is the nature of demand.

Buyers today are significantly more research-driven. Instead of chasing launch-stage discounts or speculative appreciation, they are evaluating:

- Long-term liveability

- Neighbourhood quality and future transformation

- Developer credibility and execution track record

- Rental yield potential and resale liquidity

Mumbai’s continued dominance in national housing sales of exceeding USD 1 billion for 4 years is not accidental. It reflects deep-rooted confidence in the city’s ability to generate stable long-horizon returns supported by constant population inflows, job creation and limited land availability.

Mumbai Real Estate 2026: Long-Term Fundamentals

One of the clearest signals of market strength is the extent of institutional investment flowing into Mumbai Real Estate.

Large domestic and global funds tend to flow into cities where long-term demand visibility is high and Mumbai consistently fits that profile.

Net investments exceeding USD 1.2 billion in recent years suggest that investors see Mumbai not as cyclical trade, but a core portfolio market.

This capital is primarily backing:

- High-quality residential assets

- Mixed-use and transit-oriented developments

- Prime commercial and rental-yielding projects

For end-users and individual investors, this institutional backing makes it stable, reducing volatility and reinforcing price steadiness across key micromarkets, making it incredibly attractive.

What is the Future of Real Estate in Mumbai?

Perhaps the most significant shift underway is infrastructure. For decades, Mumbai’s Real Estate growth was limited by congestion and limited mobility. Today, that equation is changing, with major infrastructure and redevelopment projects.

Projects like the Coastal Road extension, Mumbai Trans Harbour Link (Atal Setu) and multiple metro corridors are not just easing traffic, they are reshaping mental maps of the city.

Travel time, rather than distance, is becoming the new metric of value. This shift has implications like:

- Central and southern locations are regaining relevance due to faster east-west and north-south connectivity

- Emerging corridors are becoming viable for both end-use and investment

- Well-connected micromarkets are witnessing stronger price resilience or increase

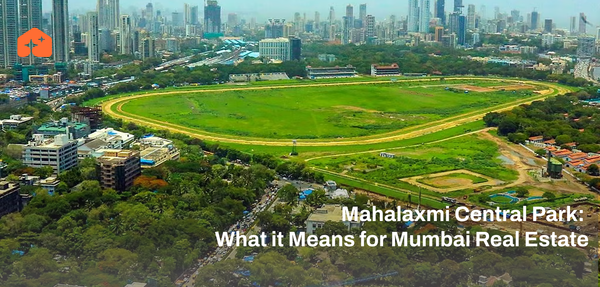

Infrastructure-led price appreciation tends to be gradual but resilient, often playing out over a 7-15 year horizon, making this phase in 2026 particularly exciting for long-term buyers. The Mahalaxmi racecourse conversion into a park is a great example of this.

For more updates on the city’s infrastructure and it's impact on real estate, join our WhatsApp community.

Mumbai Real Estate: Luxury Housing

Luxury housing in Mumbai has matured significantly. Earlier, it was often driven by status or exclusivity. Today, it is increasingly shaped by functionality, planning, and sustainability.

Buyers in the premium segment are asking deeper questions:

- How efficient is this layout for the next 20 years?

- Will the building age well?

- Is the neighbourhood future-proof in terms of access and amenities?

- Does the project offer privacy without isolation?

Sea-facing and waterfront homes continue to hold their appeal but their value is now held in place by even more factors: limited supply and lifestyle demand.

Locations such as Worli, Lower Parel, South Mumbai and BKC remain structurally strong because they combine employment access, social infrastructure and aspirational living within limited developable land.

Mumbai Real Estate 2026: Community Living

Another subtle but important shift is the growing preference for quality over quantity. Buyers are no longer impressed by long amenity lists alone. Instead, they value:

- Thoughtfully designed common spaces

- Low-density planning

- Open space and natural light

- Secure and well-managed communities

This change reflects a post-pandemic rejuvenation where homes are expected to support work, rest and recreation within the same environment.

Well-designed gated communities and mixed-use developments are increasingly seen as self-sustaining ecosystems ideal for families.

What is the Outlook for Real Estate in Mumbai in 2026?

According to a report by Knight Frank, as many as 44,277 apartments worth ₹1.30 lakh crore are expected to enter Mumbai’s real estate market through the redevelopment segment by 2030.

Areas like Bandra Bay, Lokhandwala-Andheri and Parel-Sewri have seen new launches come up in the second half of 2025.

When viewed together, several forces combine in 2026:

- Infrastructure projects moving from planning to impact

- Stable price growth projections

- Maturing buyer preferences

- Upcoming launches

Major developers are changing the landscape, the 2026 year will be the year of stability and steady appreciation. This combination suggests that the coming years may reward early and informed decisions more than reactive buying later down the line in the market cycle.

Final Thoughts

Mumbai has always been a city where real estate decisions carry generational significance. As the market enters its next phase, success will depend less on short-term decisions and more on understanding the city’s long-term direction.

For buyers and investors willing to engage deeply with location dynamics, infrastructure impact and evolving lifestyles, Mumbai in 2026 offers not just opportunity, but clarity.

To have a pulse on the market and get in-depth information on Mumbai Real Estate in 2026, join a community of Mumbai homebuyers and investors with The HomeTrust Collective.