Projections for Bangalore Real Estate 2026 would be an extension of what we know about the market currently.

2025 delivered fascinating insights into how the city is progressing. We saw North Bangalore being everyone’s centre of attention, Rajajinagar hitting ₹25,000/sq ft and Whitefield dominating sales and pulling buyer interest.

There are a lot of uncertainties, especially because of the drastic growth of property prices in certain micromarkets. Is there oversupply in the Bangalore Real Estate market? Will there be a crash in prices? Is Bangalore Real Estate a bubble?

In this blog, we will walk you through the state of the current market and explain some of the nuances, and finally tell you what our projections are for Bangalore Real Estate in 2026.

State of Bangalore Real Estate Since 2010

If we look at the market from the last 15 years, a lot of things have changed permanently. Prices have increased 3x, sales have gone up 2x and office space demand has been on an incline.

With the expansion of the IT/ITES industries and introduction of new industries like aerospace and GCCs, along with developments in public and social infrastructure, it is set to sustain residential demand.

Average Price per Square Ft

There has been a sharp incline in the average price/sq ft across Bangalore over the last 15 years. While it took 10 years for the average to double from ₹3,150 in 2010 to ₹6,150 in 2021, it only took half the time to go up by 50% again. This largely happened between 2023-2025 where it went up from ₹7,120-₹9,260.

The pattern indicates a rise that was 15% from 2022-2023 and 2023-2024 and 11% in 2024-2025. While the last year showed a decrease, there isn’t a concrete equation to determine what 2026 will look like.

Prices are dependent on demand and most central micromarkets with social infrastructure and proximity to IT hubs, as we will discuss below.

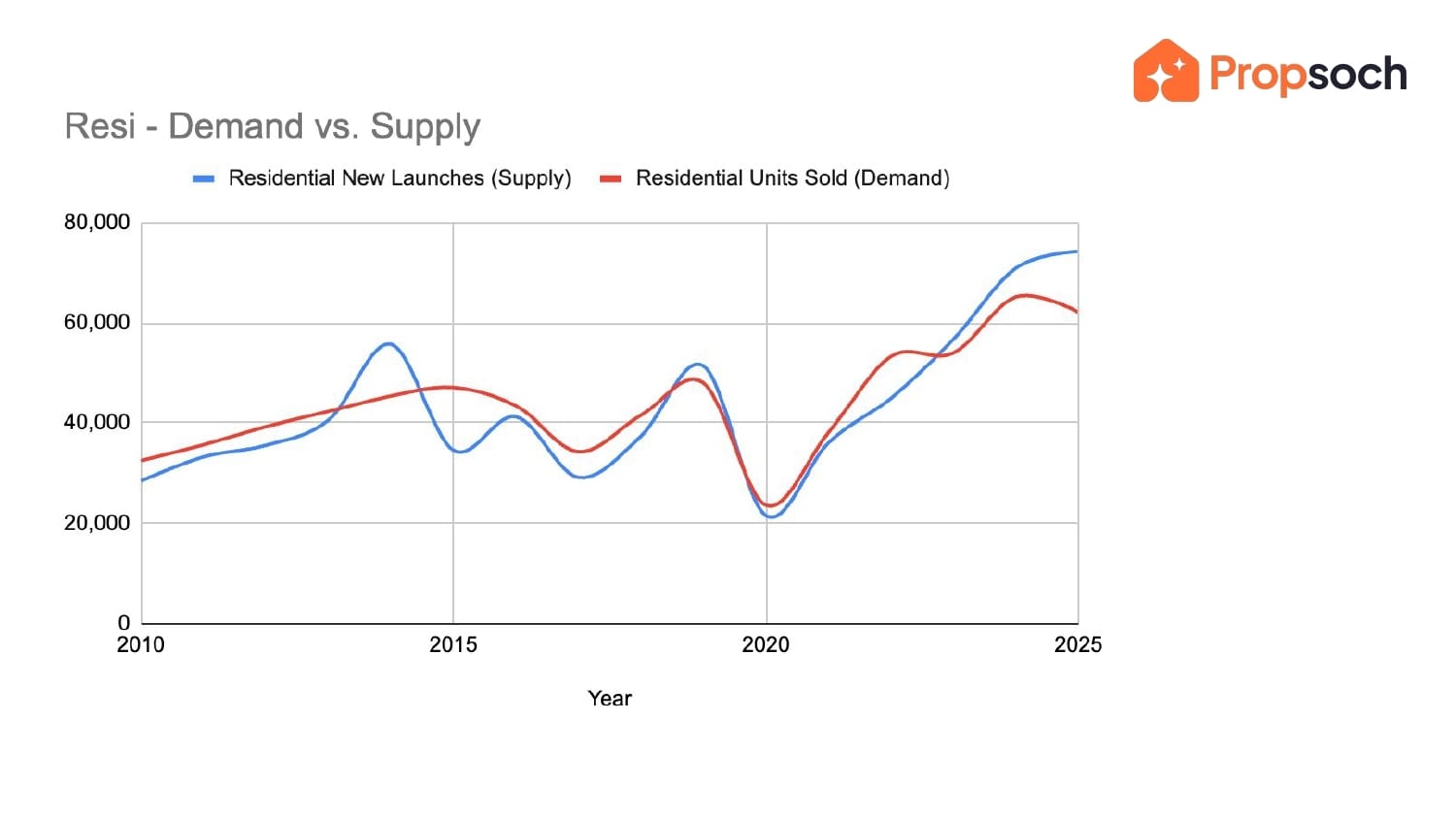

Supply Vs Demand: Bangalore Real Estate

While prices have tripled in the last 15 years, homes sold have doubled. The two factors of sales volume and prices have indicated an exponential growth in overall volume of money that goes into residential Real Estate.

The COVID pandemic saw a severe drop in the demand, which led to an equally dramatic pickup where it jumped from 24,000-53,000 homes in just two years (2020-2022). It remained stable for 2 years after which it jumped to 67,000 homes sold in 2025.

While market enthusiasts saw a connection between 2x sales and 3x prices, it is not the full picture. Prices have tripled due to sustained demand from homebuyers, which is also why there was a total of 71,000-73,000 units as new launches in 2025, a 31-35% increase from the previous year.

So no, Bangalore Real Estate is not a bubble; developers are reacting to the very real demand in the market at the moment.

Is there Oversupply in the Bangalore Real Estate Market in 2026?

The demand between 2022-2023 led developers to acquire land parcels and start the construction. The average range of this whole process from acquisition to project launch is between 9-12 months.

The graph below shows a tapering of demand when these projects started launching in 2024-25, which led people to believe that there is an oversupply in the market. This also looped in doubts about the bubble bursting from oversupply.

The picture is more nuanced than what it may seem like. While there is oversupply in certain micromarkets like Attibele, the supply doesn’t match the demand in prime micromarkets like ORR near Bellandur/Marathahalli.

On a zoomed in level, it is evident that the demand far outstrips supply in certain micromarkets, and supply outstrips demand in certain speculative micromarkets. The reason being the increase in prices in such micromarkets.

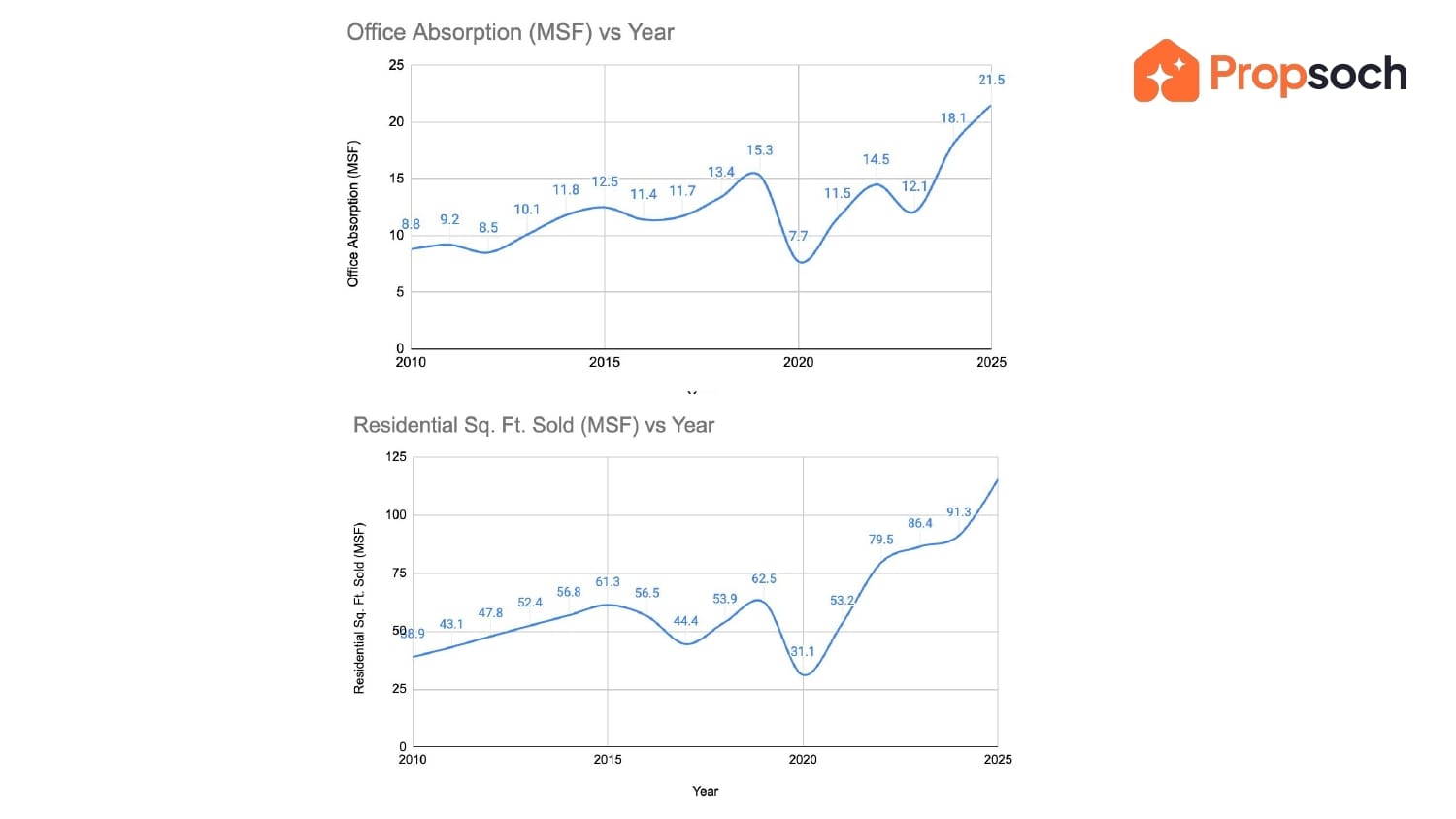

Office Absorption & Residential Demand: Bangalore Real Estate 2026

A surefire way to understand or even project residential demand in a market like Bangalore is to look at the demand for office spaces. Office absorption by GCCs and expansion of IT/ITES campuses at large controls residential demand.

Every employee is dedicated around 100-150 sq ft of overall leasable space. This figure doesn’t just include their desk and chair, but all the common areas, which when divided by number of employees, typically lies in that range.

Within this group, it is important to know what percentage of people rent vs buy. It is typical for employees who migrate to rent for the first 4-5 years, after which they could potentially decide to settle in the city. This is around when they are assumed to buy a property in the city.

Every square foot of office space generates 5-10x of residential demand. On the same logic, a drop in commercial leasing coincides with a proportionate drop in residential sales. This trend has been observed for the last 15 years.

In 2020, there was a dip in office space absorption down to 7.7M sq ft, and residential sales dropped to 31.1M sq ft. When in 2025 it picked up to 21.5M sq ft, residential sales have also gone up to around 110M sq ft.

North Bangalore micromarkets like Bagalur or Airport Road have been put on the Bangalore Real Estate map because of the opening of new campuses in the area. The area has already seen a massive increase in new launches of 24,000 units in 2025 which testifies to this fact.

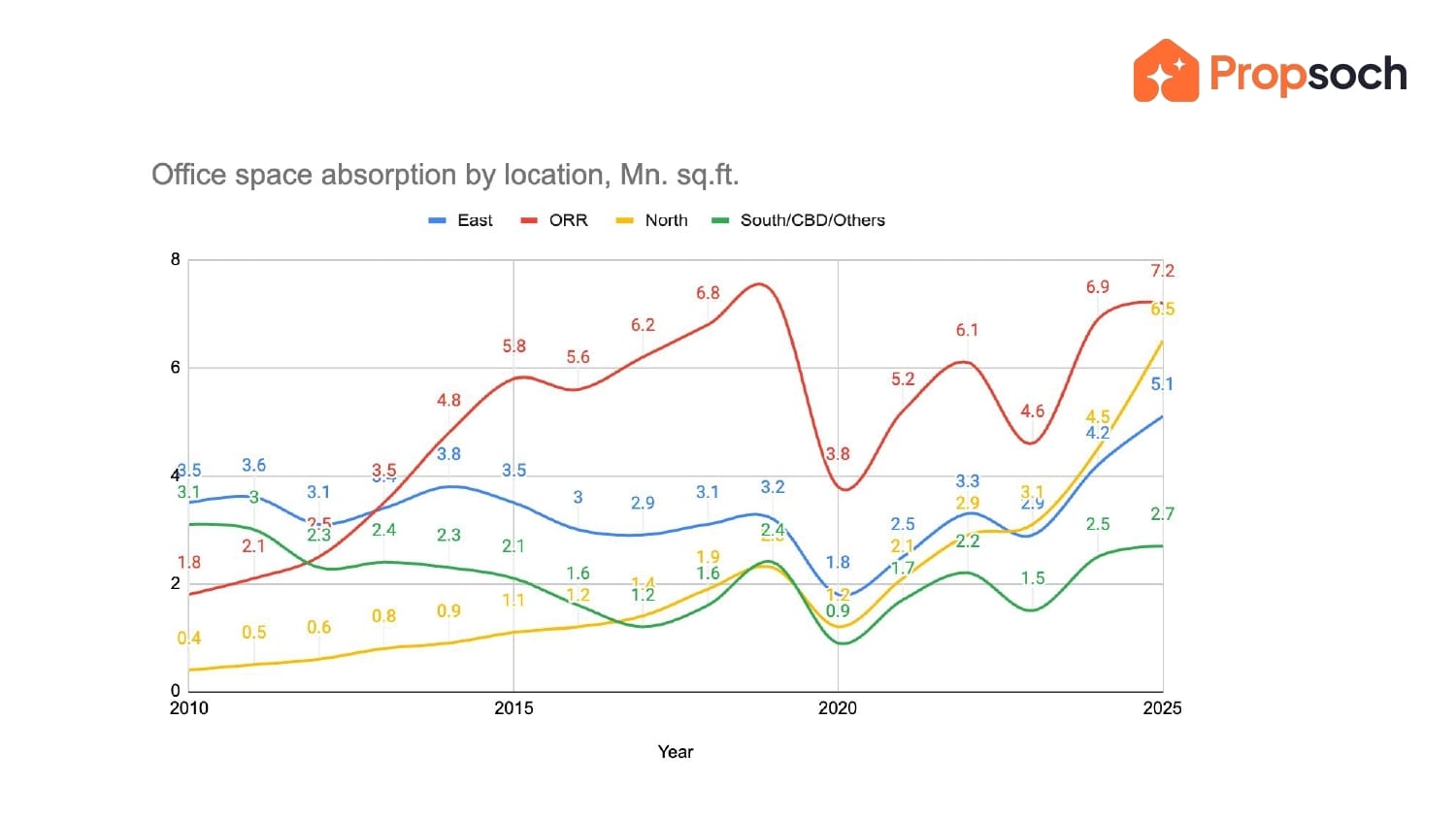

Office Space Demand: Bangalore Real Estate

Outer Ring Road (ORR) has been dominating office space demand since 2014. It is interesting that North Bangalore which was barely worth attention in 2010 has risen sharply to compete with ORR in 2025.

In comparison, South Bangalore has been steady with slight expansion of existing companies.

Ashish Acharya, founder at Propsoch with 19+ years of experience in Bangalore Real Estate says:

“15 years of data shows us that people typically tend to move closer to work spaces. Prices tend to appreciate better closer to office spaces.”

What that translates to, is that Bangalore Real Estate 2026 will continue to be influenced by the growth shown by ORR and North Bangalore. There will most likely be continued residential demand in those areas.

How Does Office Space Influence Residential Demand?

Demand is calculated by the number of pre-leases and RFPs (Request for Proposal) that companies sign with developers. This is when companies approach developers to express interest in a building or a project.

An example of this is when Amazon signed a pre-lease of over 1 million sq ft office space with Sattva Horizon in North Bangalore. This would have led to a 5-10x increase in residential demand in the area.

ICMR market report notes a 15-16M sq ft increase in office absorption in 2026. It is a slight decrease from 21M sq ft in 2025, but nothing drastic.

The question then is: Will Bangalore Real Estate crash in 2026? Will you be overpaying if you buy now?

The short answer is most likely not. If the rule of thumb is followed, then a 15-16M sq ft increase of office space absorption will lead to around 80M sq ft increase in residential demand in 2026.

This means that the residential Real Estate market in Bangalore 2026 is likely to be on a similar trajectory and less likely to crash.

The demand for housing near office spaces will continue to maintain prices in established micromarkets. The case might be different for speculative micromarkets like South Bangalore, but any new plans for development might have the capacity to turn that around.

Will Real Estate Prices Fall in Bangalore?

Pricing is largely dependent on demand and when there is high demand, the price/sq ft goes up. Several micromarkets in 2025 saw a significant increase in prices and it’s safe to assume that there is a demand from homebuyers.

Refer to the table below to understand the increase in pricing from 2024-25. This is the case largely due to demand from various factors like proximity to office spaces, social and public infrastructure and introduction of new industries.

Considering the fact that Bangalore Real Estate has been on a steady rise over the last few years and that there is a projected 80M growth in residential demand in 2026, the answer is no.

The city has been progressing at a rapid rate and the livable conditions are advancing to fit this population. Additionally, developers are reacting to the increasing number of homebuyers every year and increasing supply.

In this scenario, prices are very unlikely to fall. This is not grounds to rush your decision, but to have a realistic view of how you can plan this life decision appropriately. The truth is that Bangalore Real Estate will not drop in value when most homebuyers are cashing in on market prices.

Final Thoughts

Bangalore Real Estate in 2026 will most likely follow the trajectory set by 2025. North Bangalore had 24,000 new launches and East Bangalore had the most sales (32,900 homes of the total 67,000). In terms of new launches further down the line, office absorption has a role to play here.

As of now, ORR and North Bangalore are leading in terms of office space, which might drive up residential demand in the area. Since 15-16M sq ft office space has been pre-leased, the demand might be around 80M sq ft.

Bangalore Real Estate has been fueled by sustained demand from homebuyers and will continue to be in 2026, especially from public, social, and economic developments.

If you want more information on Bangalore Real Estate in 2026, stay tuned for our State of Bangalore 2026 series where we will discuss topics like placement of Bangalore in global Real Estate, price/sq ft of each micromarket, infrastructure analysis, investment matrix, and many more.

For information like this, join our WhatsApp community where our expert advisors share real-time updates on the market!