The concept of fair pricing itself is one wrapped in confusion when you try to evaluate the value of your property.

There are several ways to “justify” a price, and sales agents use several tactics to give the illusion of fairness. However, it’s important to look at the whole picture to truly understand the fair market value of a property.

You might instinctively compare two properties, but the reality is that there are so many things you have to consider, such as amenities, location, open area, unit density, etc., as all of these affect pricing.

However, comparable data is the best method to understand pricing better. “Market value” is a real thing that is driven up due to demand. It’s unrealistic for one to be on top of how this market value rises, which is why comparable data takes away a lot of the guesswork and gives you concrete data to work with.

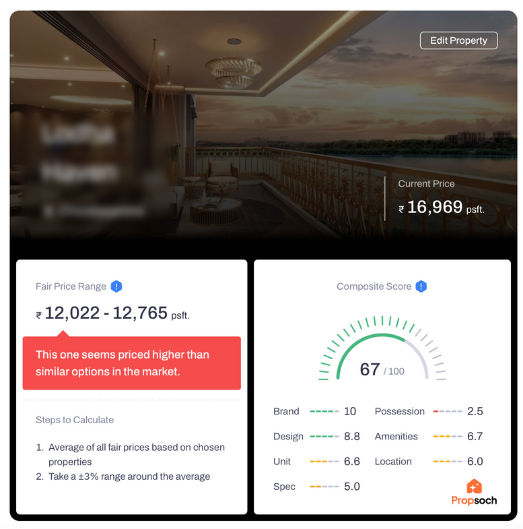

Our Fair Price Calculator performs a comprehensive analysis on any project of your choice, letting you know if it’s priced fairly based on the project strength.

What Does Comparable Data Mean When Evaluating the Fair Property Value?

Real estate is largely a cat-and-mouse game of demand and supply, and pricing is a major factor in this process. In this context, looking at the market at large gives you a greater understanding of what you can expect from how your unit or property should be priced.

In simple terms:

Comparable data in real estate is when you compare your unit to similar properties in the same location to understand how it stands in the market.

Having this data at hand will help you understand if you’re paying fairly for a property or not. For example: if a 2BHK in a property in a location is priced at 1.8Cr with no amenities, then you might be impressed that a 2BHK in a property with a large club house, open area, and a running track is priced at 2.2Cr.

This is why it helps in a big industry like real estate where horror stories, pricing red flags, and con artists thrive. You have to empower yourself with information and comparable data is useful to ensure that you don’t overpay.

What Is Comparative Market Analysis (CMA) in Real Estate?

Instead of conducting a pricing analysis while evaluating the fair market value of a property yourself, a Comparative Market Analysis provides you with the exact framework to do it.

Comparative Market Analysis (CMA) in real estate is the comparison of sold or pending properties in a set location that are similar to the subject unit.

By conducting a thorough analysis, it is possible to validate a quoted price by using data instead of guesswork or intuition. You should hold onto your intuition, but having the data to back it will give you the justification to negotiate prices.

Common Property Pricing Red Flags Buyers Should Watch For

Have you ever been to a site visit where you’ve heard the following from agents:

- This tower will have a park by the end of next year

- We will have a gym in the next building for all residents very soon

- This is the last unit left at this price

This happens too often where the pricing is based on future promises and not current market conditions or reality. Adding to that are the pressure tactics that take away from you making a well-informed decision with time and patience.

Price appreciation is a very real concept and should 100% be on your mind when you look for properties, but that is vastly different from un-verifiable information that’s almost never in writing.

All of this leads to the lack of a pricing logic. Without comparable data, you might think that a future gym is worth the price tag they quote. However, through the property price comparison method, you might be surprised to know that there could be a similarly priced unit with many more features in the vicinity.

How Can You Validate a Quoted Property Price?

There are a lot of factors to fully evaluate the fair market value of a property such as developer pedigree, location, neighbourhood, project amenities, possession timeline, among others.

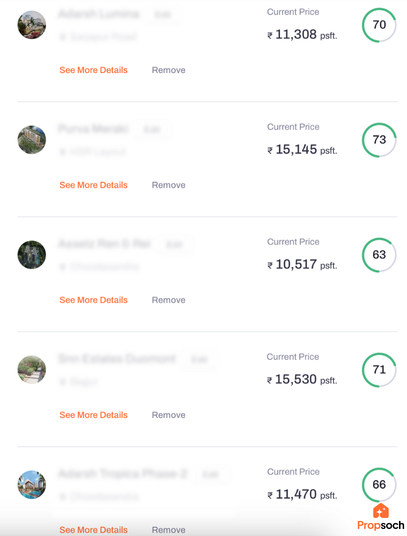

Our Fair Price Calculator rates every property based on 7 of these factors:

- Brand

- Location

- Possession

- Unit

- Design

- Specifications

- Amenities

A comprehensive list like this is what you need to determine whether the price is fair based on its individual qualities. You can then compare it to other properties of your choice to get a well-rounded picture.

The Fair Price Calculator will present you with 5-10 similar projects from the same neighbourhood, and you can choose to edit that out to compare your favourite properties.

We will walk you through how we grade these factors, and what makes a project get a higher score.

Brand

Developer history or pedigree discusses quality and reliability of developers. This could influence deliverance on promises, possession, and general trust.

Developers have an informal grading system that ranges from A to D. The fair price calculator rates the higher grades better than the lower ones.

Location

This could be one of the most important factors in finding the fair market value of a property, and for a reason. We rate a project’s location by looking at the following:

- Nearest metro

- Nearest schools

- Nearest hospitals

- Nearest malls

- Nearest office spaces or IT parks

- Challenges in the neighbourhood

- Positives in the neighbourhood

Projects that get a higher score for all of the positive elements will get better ratings compared to those that are lacking in this area.

Possession

With all the new launches around the city, certain properties can grab your attention, to find out that you can only move in 2-4 years later.

The tool ranks projects with a shorter possession timeline higher than those that would take longer. For example, a 6-month possession is ranked better than a 3-year possession.

Unit

In this section, the tool checks for unit-specific information. This is an important section as this is the space that you will live in.

The research team at Propsoch will gather information such as balcony area, carpet area as compared to saleable area, and the floor-to-ceiling height of the unit.

The final score will depend on how the unit will perform against these three factors.

Find out if your project’s unit factor has a high rating.

Design

What makes the design of a property is a combination of how easy the spaces are to access and the efficiency it allows when it comes to movement. This is one of those factors that often go by unnoticed when compared to others, but contributes to the fair market value of a property.

The tool takes into account open area, unit density, and elevator crowd factor. These elements will paint a picture of how crowded a space could potentially get, and will influence your quality of living.

Specifications

The quality of the fixtures and equipment strongly influence the longevity of a place and how often you would have to do maintenance on them.

Fixtures like sinks, WCs, showers, chimneys, countertops, among others are taken into consideration. The tool ranks premium specifications higher than low-quality ones.

Amenities

One of the more exciting things about a project could be the amenities. The research team at Propsoch evaluates the number of amenities alongside factors like project area, park area, and the clubhouse area compared to the number of units in the project.

The composite score you get at the end of the evaluation is what the tool uses to compare to other projects in the area. The tool will let you know if there are any inconsistencies in pricing and if it is the fair market value of a property.

For more details on a RERA-registered project of your choice, you can visit our dedicated property pages. We go into detail about these individual factors with the numbers so you can decide what’s ideal for your homebuying journey.

Final Thoughts

One comment we often hear is “I wish I had known this before.” At Propsoch, we are dedicated to eliminating buyer’s remorse. We do not see price validation or transparency as optional but the bare minimum you need as a buyer.

Instead of opinions and assumptions, we want you to have the comparable data on projects so you truly know what you should pay and if that matches the quoted price or not.

We understand that you want to make the best possible decision for such a big investment, and we are on the same page as you. The regret of overpaying for a property that you’re not happy with far outweighs the effort of research.

Use our Fair Price Calculator to see if a project you’re interested in is overpriced or priced fairly!

FAQs

How can I negotiate prices as a homebuyer?

To negotiate a fair price, what you primarily need is knowledge on how the project fares compared to similar projects in the area. If another project offers a better deal with similar qualities, then you can ask for a pricing breakdown or negotiate for a lower price.

How do builders price apartments?

A lot of factors influence pricing like developer’s brand, location, project design, amenities, specifications, unit type, and possession. This is in addition to the market rate in the micromarket.

How do I know if a property is overpriced?

If you perform a comparative market analysis and find that other projects that appear to be better are marked lower than your subject property, then that might be a pricing red flag. However, it’s not that simple and you would have to perform a thorough analysis of the project to fully know. Use the Fair Price Calculator to know if your property is underpriced, priced fairly, or overpriced.